Forex Technical Analysis 2012/30/07 (EUR/USD, GBP/USD, USD/CHF, AUD/USD, USD/CAD) Forecast FX

27.07.2012

Forecast for July 30th, 2012

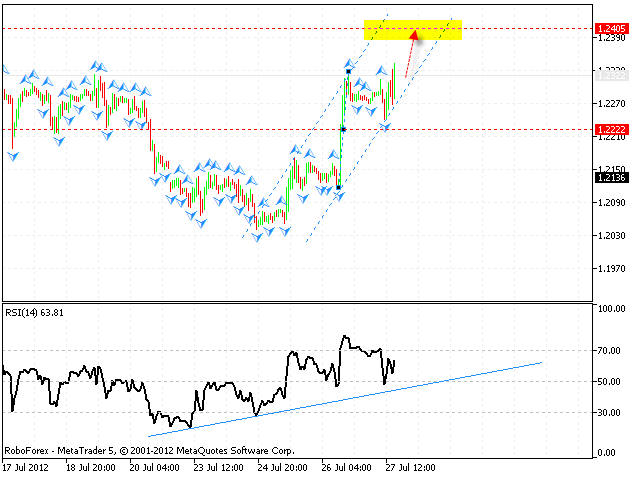

EUR/USD

The EUR/USD currency pair is still being corrected. The price is forming the ascending symmetrical pattern with the target at the level of 1.2405, one can consider buying the pair from the current levels with the tight stop. If the price falls down lower than 1.2225, this scenario will be cancelled. The test of the trend’s ascending line at the RSI is an additional signal to buy Euro.

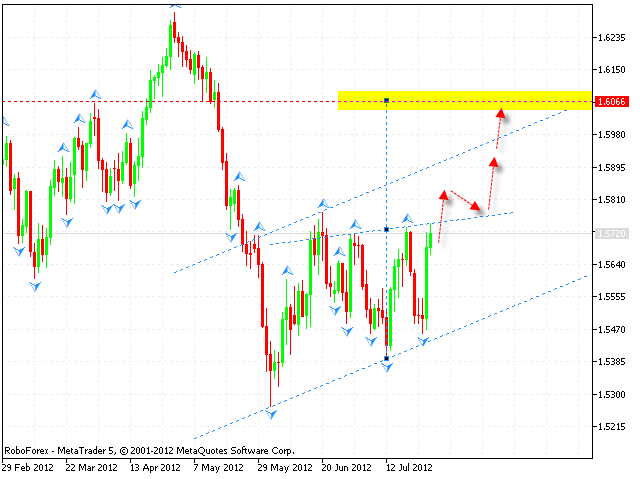

GBP/USD

The GBP/USD currency pair is also being corrected. At the daily chart we have “upside down head & shoulders” reversal pattern forming, the pair is expected to continue growing up. The target of the growth is the area of 1.6065. One can consider buying the pair after the price breaks the level of 1.5810. If the price falls down lower than 1.5470, this scenario will be cancelled.

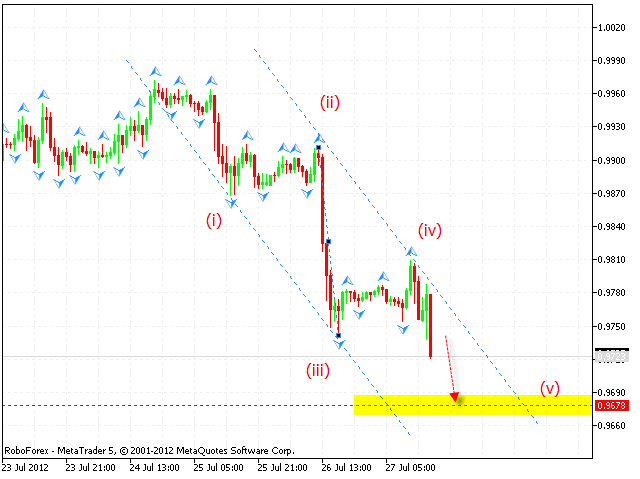

USD/CHF

The same as the EUR/USD and GBP/USD currency pairs, the USD/CHG one is being corrected. At the H1 chart the price is forming the descending pattern with the target of the fall in the area of 0.9678. One can consider selling Franc with the stop above 0.9810.

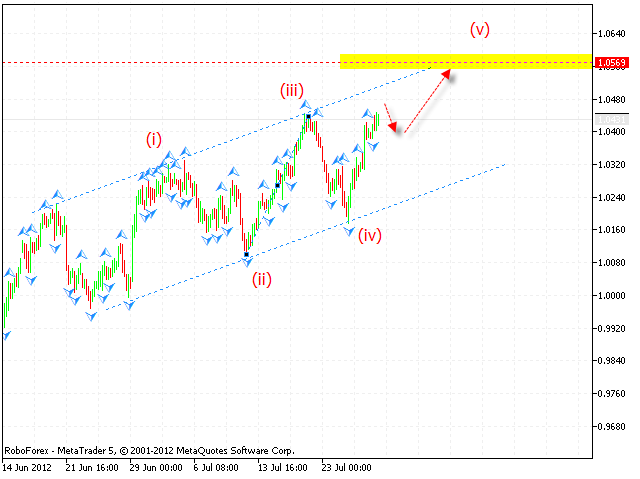

AUD/USD

Australian Dollar has tested the resistance area. The price is forming the ascending pattern with the target of the growth in the area of 1.0570. At the moment we should expect the pair to be corrected towards the level of 1.04, where one can try to open long positions with the tight stop.

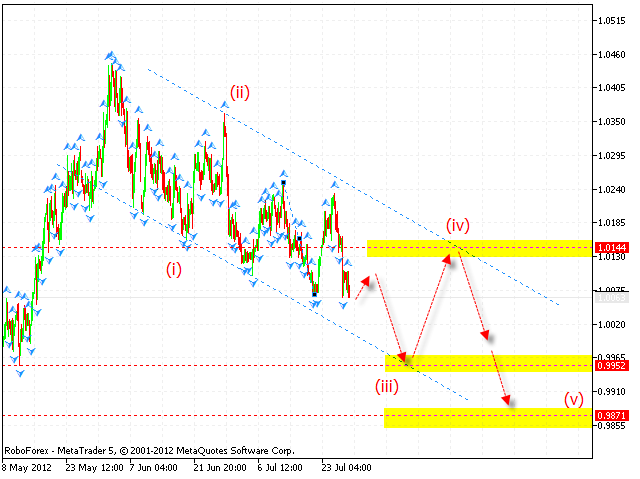

USD/CAD

Canadian Dollar continues moving inside the descending channel. We should expect the price to test the area of 0.9950, and then start the correction towards the descending channel’s upper border in the area of 1.0145. The final target of the fall is the area of 0.9870.

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.