Forex Technical Analysis 17.06.2013 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, GOLD)

17.06.2013

Analysis for June 17th, 2013

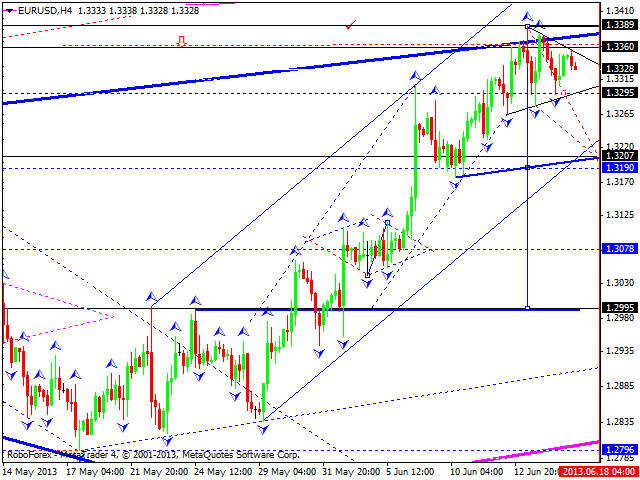

EUR/USD

Euro is still consolidating near its maximums; the market is forming triangle pattern. We think, today the price may form a new descending structure with the target at 1.3200, which may be considered as the first wave. Later, in our opinion, the pair may form a correction to return to the level of 1.3295.

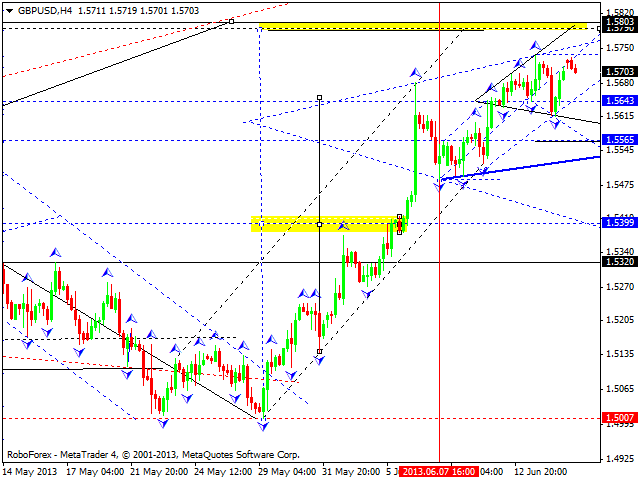

GBP/USD

Pound is moving inside an ascending channel; this morning the market was opened with a gap up. We think, today the price may form a descending correction towards the level of 1.5230. Later, in our opinion, the pair ay return to the level of 1.5790 and only after that start a new descending correction.

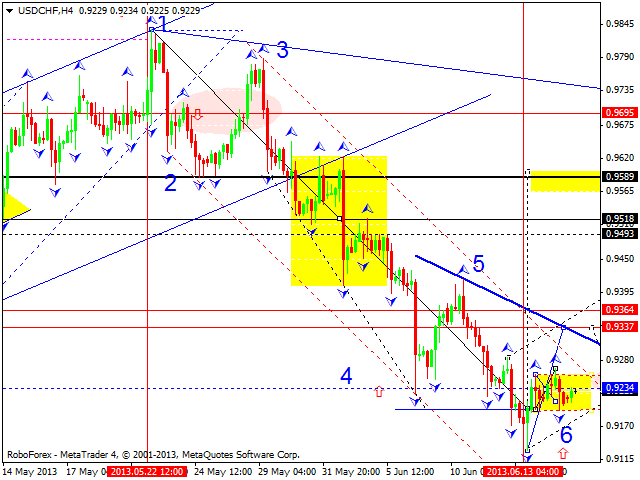

USD/CHF

Franc is forming the first ascending structure inside the first wave with the target at 0.9590. We think, today the price may continue forming this first structure; its first target is at the level of 0.9337. Later, in our opinion, the pair may start a descending correction towards the level of 0.9234.

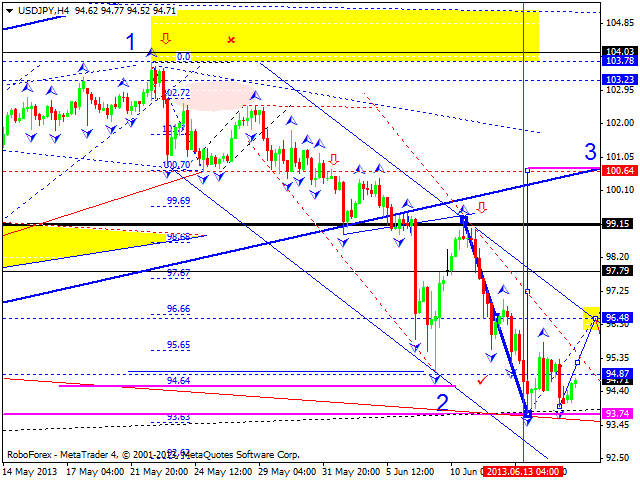

USD/JPY

The USD/JPY currency pair is still moving downwards; the main scenario implies that the instrument may continue forming an ascending correction to return to the level of 99.20 (at least). We think, today the price may reach the first target at 96.48 and then fall down towards the level 94.90 (as a correction).

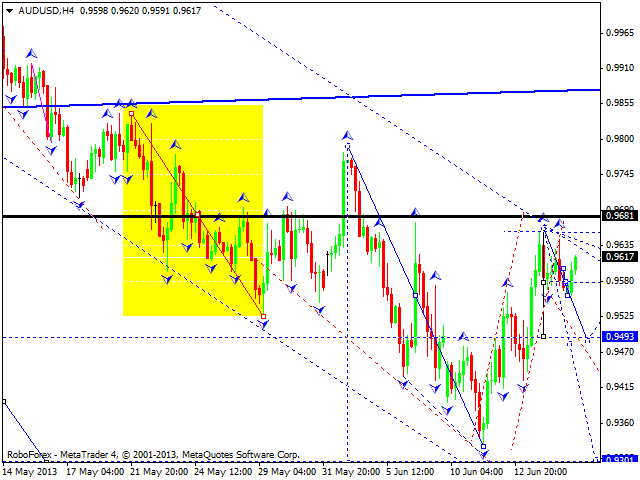

AUD/USD

Australian Dollar completed its ascending correction. We think, today the price may continue forming another descending wave and reach the first target at 0.9495.

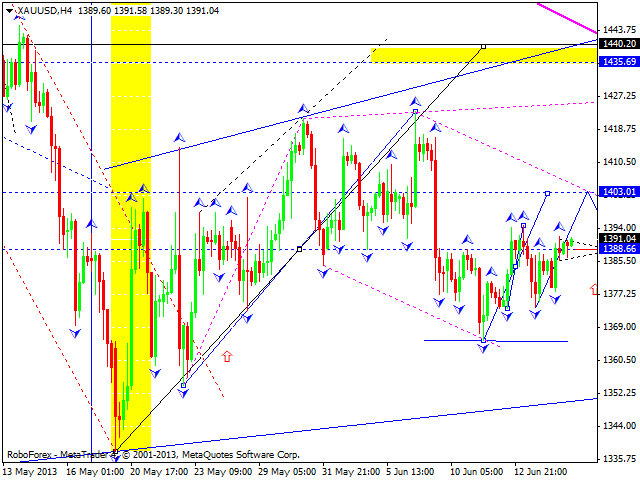

GOLD

Gold continues moving upwards. We think, today the price may form the fifth structure of this wave with the target at 1403. Later, in our opinion, the instrument may form a slight correction and then continue growing up towards the target at 1440.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.