Forex Technical Analysis 30.01.2013 (EUR/USD, GBP/USD, USD/CHF, USD/JPY, AUD/USD, GOLD)

30.01.2013

Analysis for January 30th, 2013

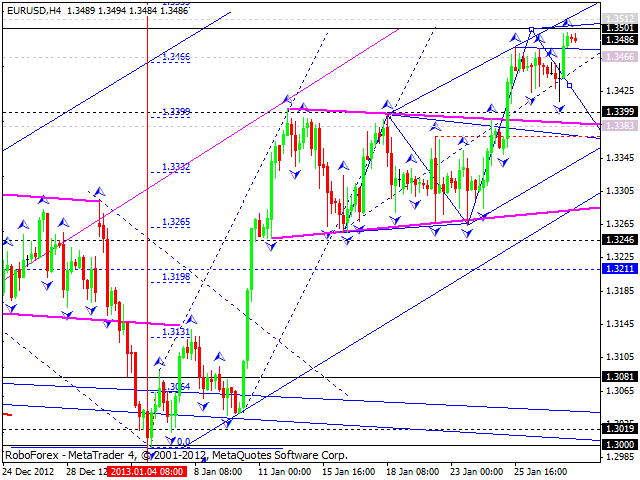

EUR/USD

The EUR/USD currency pair continues moving upwards. The market hasn’t been able to reach a target level so far; at the moment the price is just several pips away from it. I think today the pair grow up a little bit and then form a pivot point to make a reverse and start a correction towards the level of 1.3080.

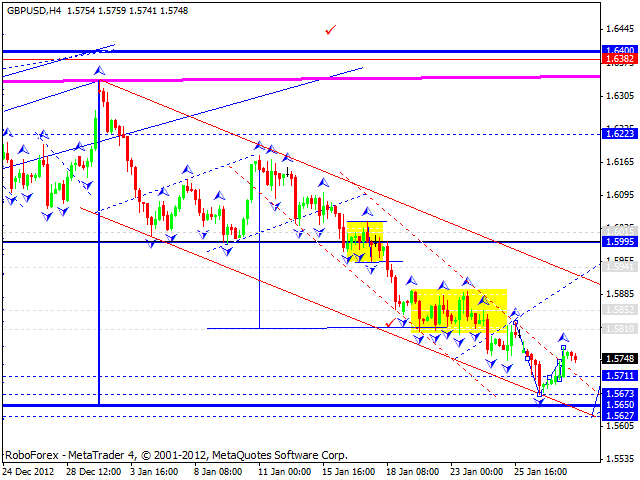

GBP/USD

The GBP/USD currency pair has already formed tow ascending impulses and today may form another one. Only after that we will have a chance to define if the price is going to continue growing up. However, in my opinion, before that the pair needs to renew its minimum once again.

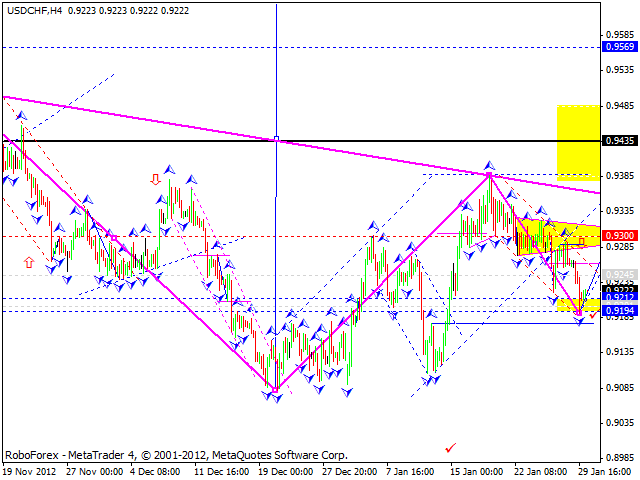

USD/CHF

The USD/CHF currency pair finished a correctional wave and now the whole structure may be considered completed. This pattern looks like head & shoulders, a classical reversal pattern. If the price leaves the pattern from the right shoulder, the pair may start a new ascending wave.

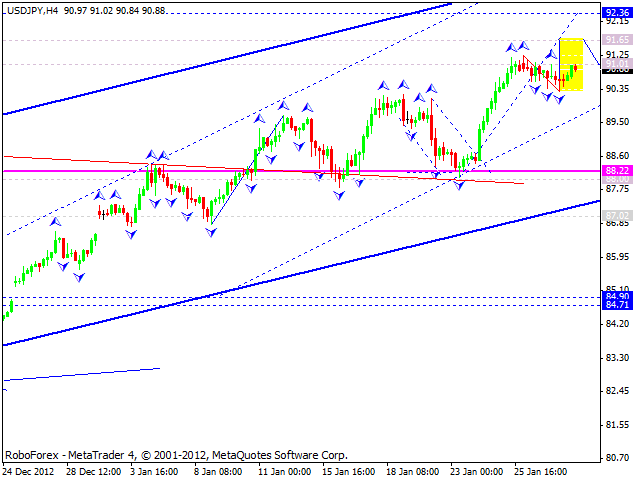

USD/JPY

The USD/JPY currency pair is still moving near the level of 91. I think today the price may continue growing up to reach the level of 91.60 or even 92.30, and then start forming a new consolidation channel towards the target at 94.70.

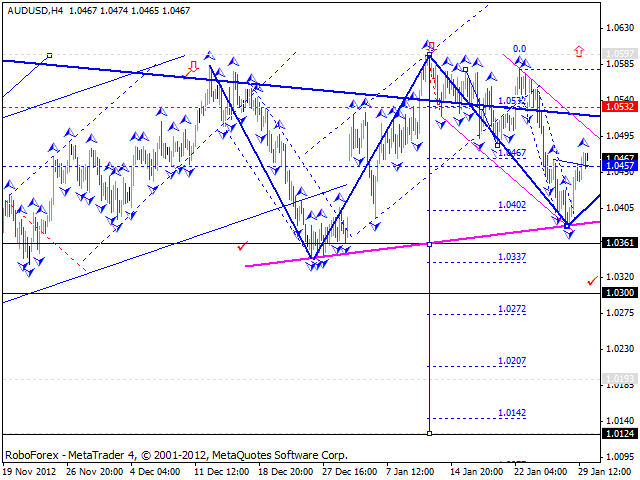

AUD/USD

Australian Dollar continues moving near the level of 1.0455; the pair formed a continuation pattern to grow up and reach the target at 1.0530. In my opinion, the whole structure may be considered as reversal pattern, head & shoulders. The targets of this structure are at the level of 1.0125.

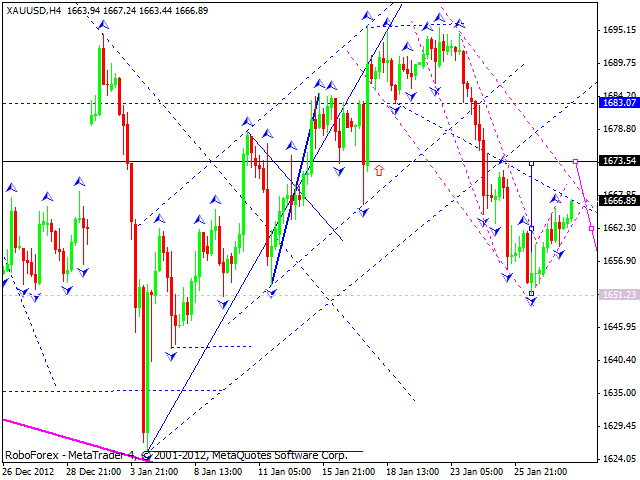

GOLD

Gold continues moving upwards. I think today the price may grow up to break the level of 1673 and then try to reach a new local minimum again.

RoboForex Analytical Department

Attention!

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.