Fibonacci Retracements Analysis 10.05.2021 (GOLD, USDCHF)

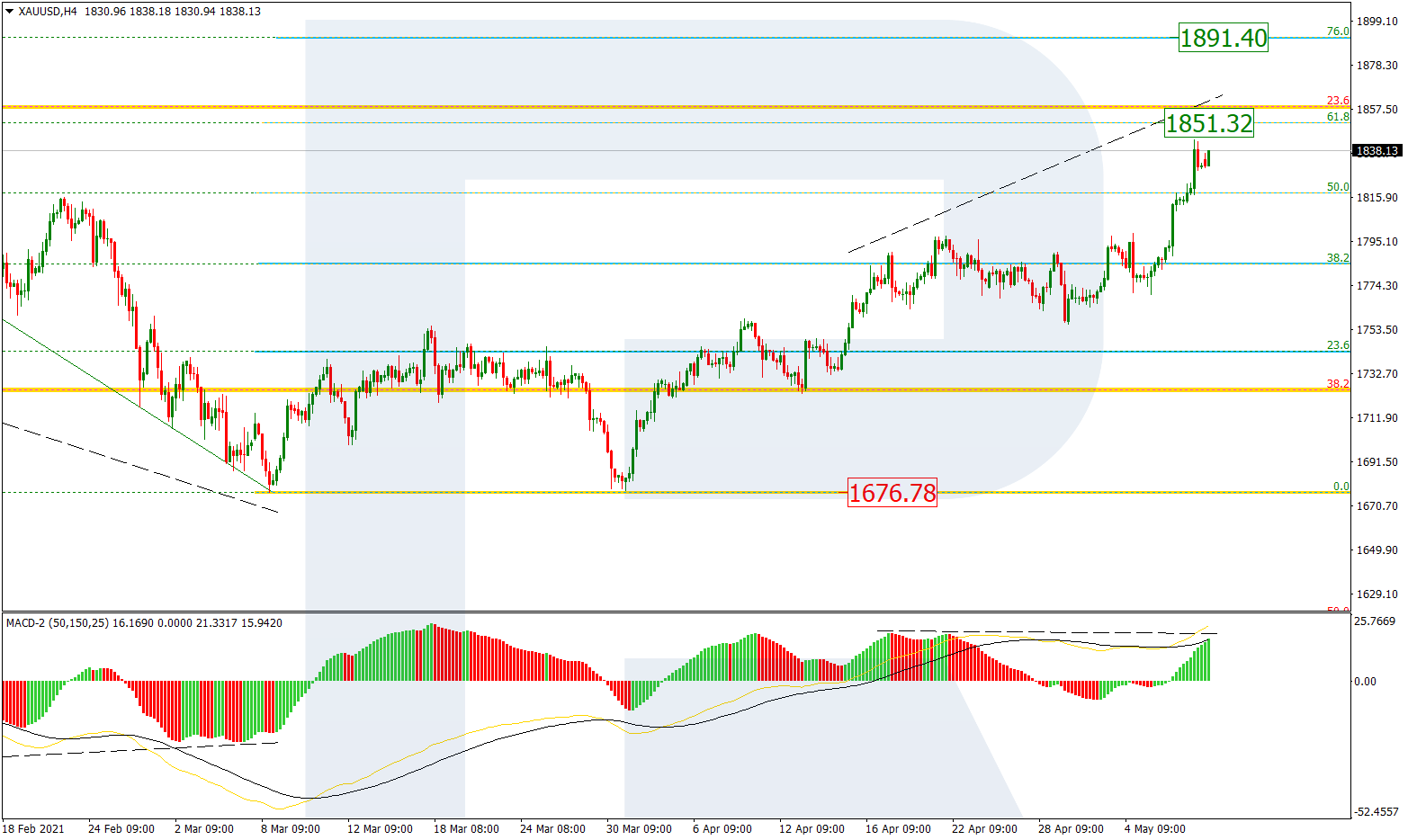

XAUUSD, “Gold vs US Dollar”

As we can see in the H4 chart, the uptrend continues. After breaking 50.0% fibo, XAUUSD is approaching 61.8% fibo at 1851.32 and may later break this level as well. In this case, the next upside target will be 76.0% fibo at 1891.40. However, despite the fact that the current uptrend is quite stable, there is a divergence on MACD, which may hint at a possible reversal. The key support is the low at 1676.78.

In the H1 chart, after completing the ascending impulse, the pair is forming a short-term consolidation range and may later resume growing to reach 61.8% fibo at 1851.32. However, if this range transforms into a correction, the target will be at 1818.00.

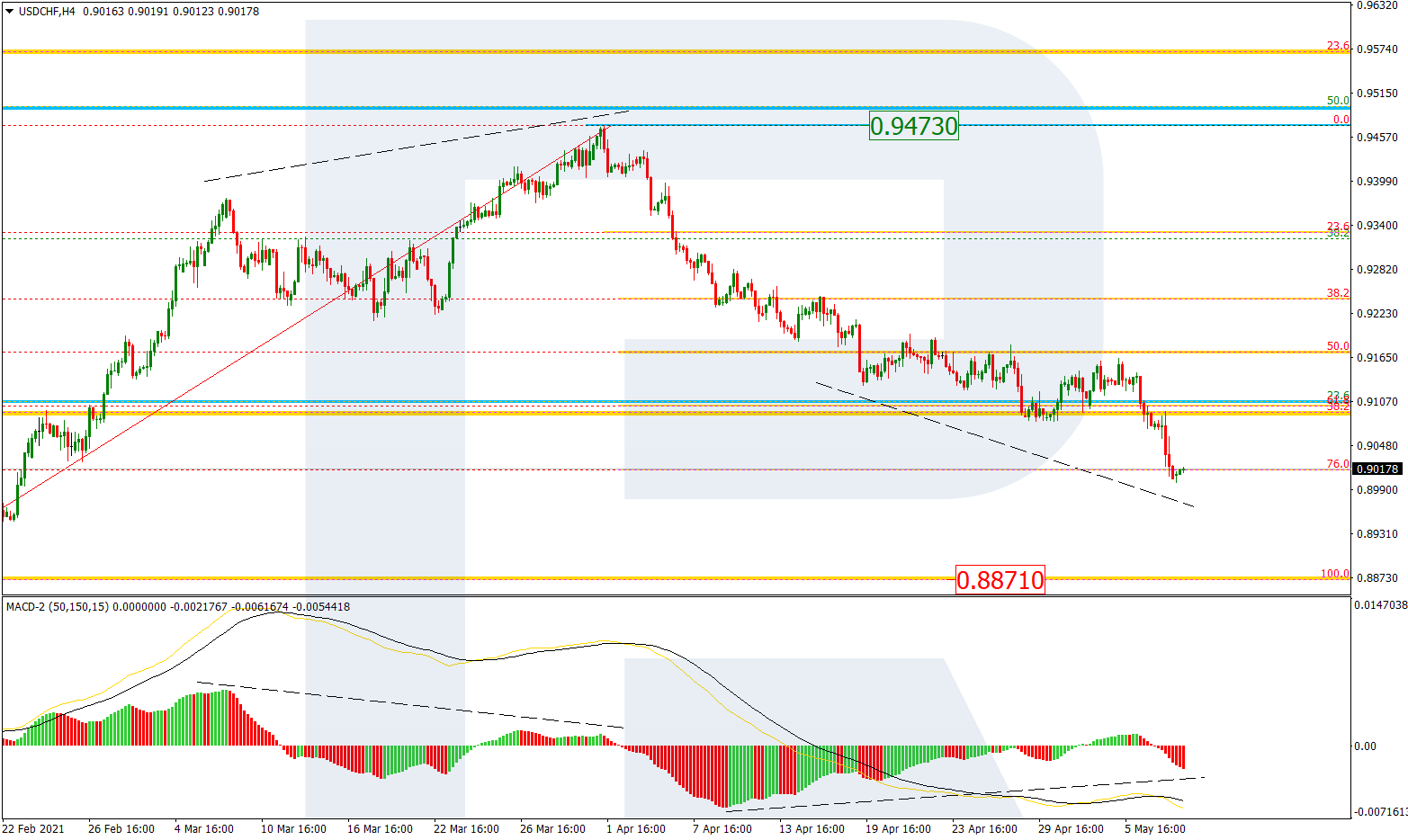

USDCHF, “US Dollar vs Swiss Franc”

In the H4 chart, after finishing the short-term pullback, the asset is forming a new descending impulse, which has already reached 76.0% fibo. At the same time, there is a convergence on MACD, which may hint at a correctional uptrend soon. Still, the key downside target remains the fractal low at 0.8871.

The H1 chart shows potential correctional targets after a convergence on MACD – 23.6%, 38.2%, and 50.0% fibo at 0.9112, 0.9181, and 0.9236 respectively. The local support is the low at 0.9000, a breakout of which may lead to a further downtrend.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.