EURUSD surges above 1.1300; will the rally continue?

The EURUSD rate continues to rise, breaking above the 1.1300 level amid ongoing US dollar weakness. The outlook for further gains remains uncertain for now. Discover more in our analysis for 23 May 2025.

EURUSD forecast: key trading points

- Market focus: Germany’s final Q1 GDP growth rate came in at 0.4%

- Current trend: moving upwards

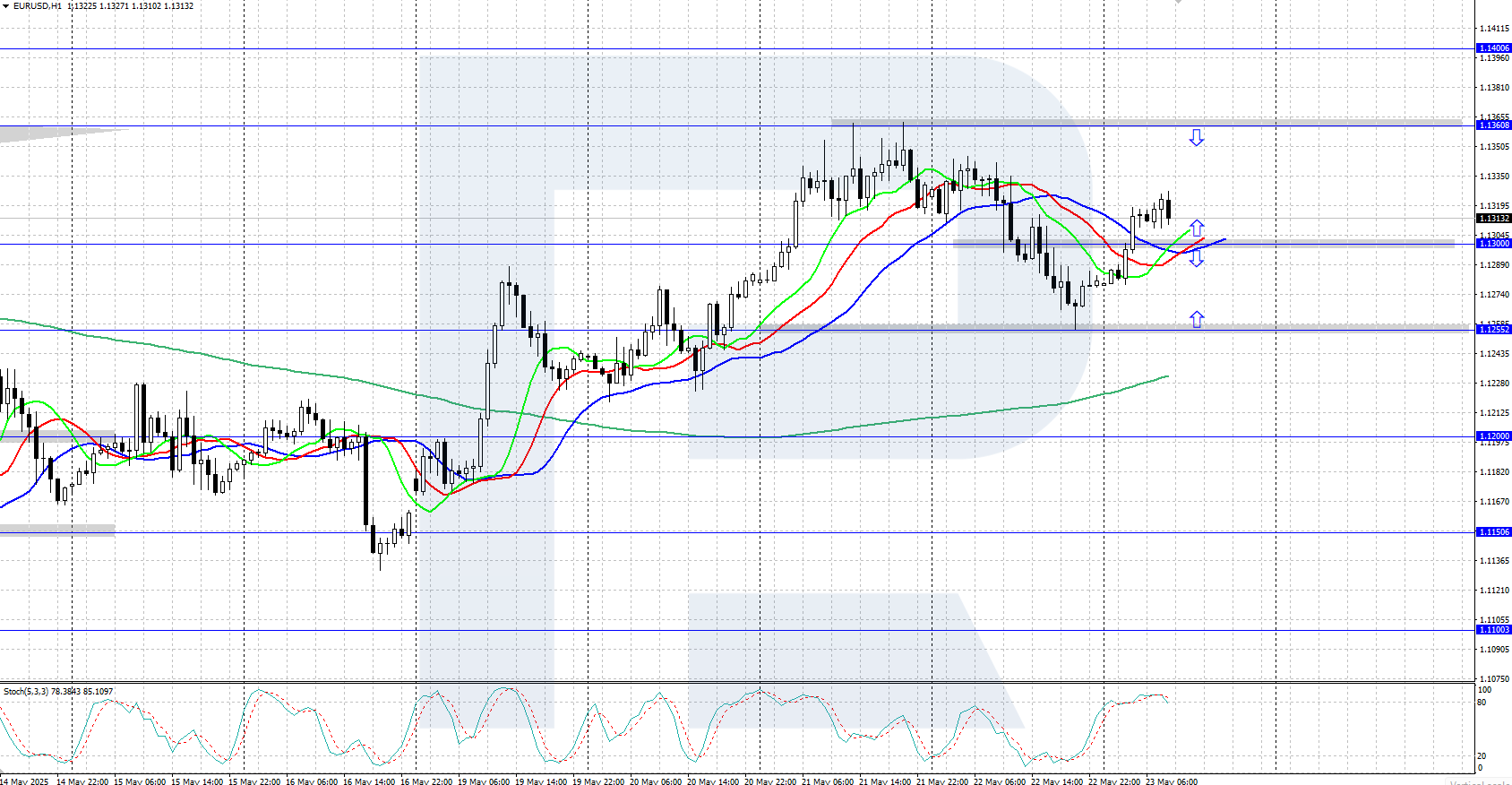

- EURUSD forecast for 23 May 2025: 1.1255 and 1.1360

Fundamental analysis

The EURUSD pair is on the rise due to growing concerns over US fiscal policy. President Trump’s new budget proposal, which includes tax cuts and increased defence spending, has sparked fears of further ballooning the US national debt.

Federal Reserve Governor Christopher Waller recently stated that there’s still room for rate cuts this year, depending on how Trump’s tariff policy unfolds. Market anticipation of a Fed rate cut continues to weigh on the US dollar.

EURUSD technical analysis

On the H4 chart, the EURUSD pair shows strong upward momentum, climbing above the 1.1300 level. The Alligator indicator is moving upwards, supporting the bullish trend. The key support level for continued growth now lies at 1.1255.

The short-term EURUSD forecast suggests further growth towards 1.1360 in the near term if bulls hold the price above 1.1300. Conversely, if bears push the price below 1.1300, the pair could correct towards the 1.1255 support level.

Summary

The EURUSD pair has risen above the 1.1300 level as US budget concerns weigh on the dollar. The Fed is waiting for Trump’s tariff policy to be settled before proceeding with further monetary easing.

Forecasts presented in this section only reflect the author’s private opinion and should not be considered as guidance for trading. RoboForex bears no responsibility for trading results based on trading recommendations described in these analytical reviews.